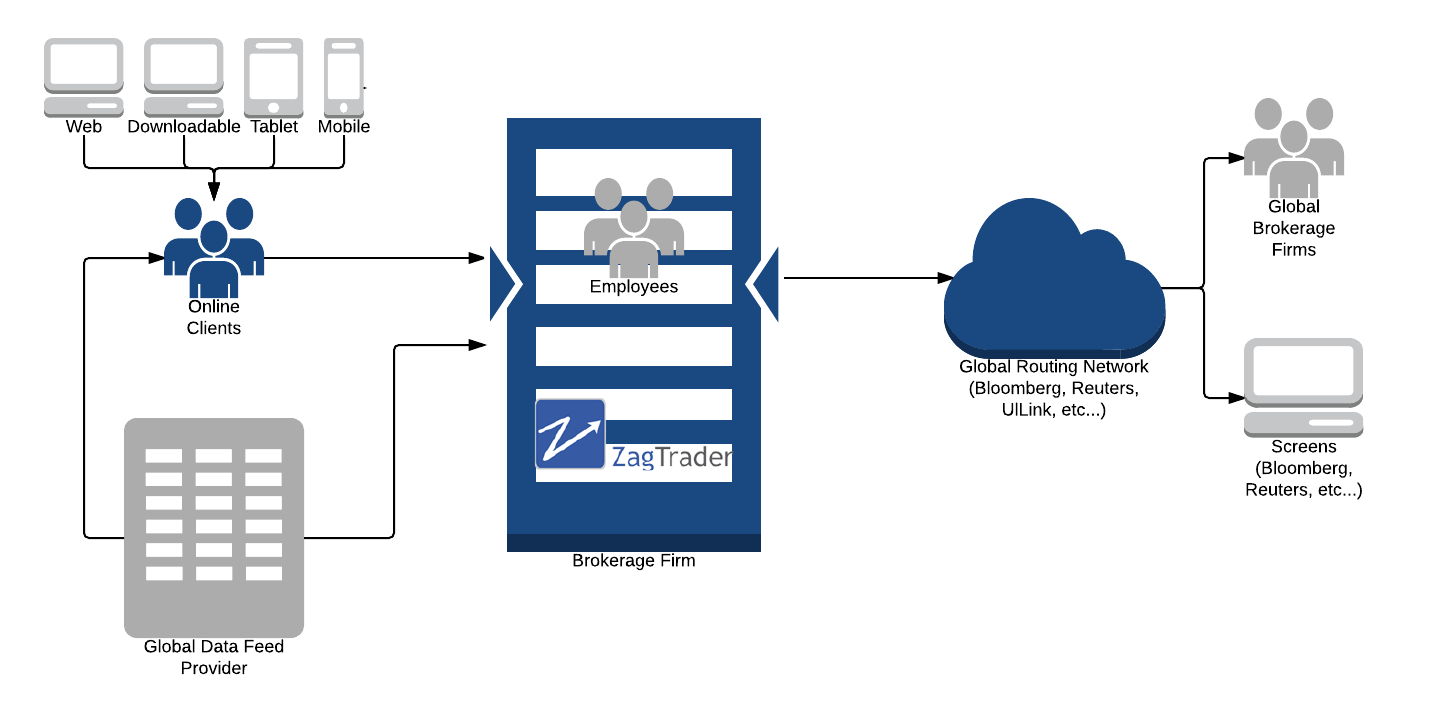

With the ZagTrader Buy-Side solution, providing a feature set which includes broker neutral access to any broker and algorithmic destinations available; global support on a multi-asset, multi-currency platform, working trade analytics, benchmark comparisons in real-time and robust post-trading. The solution will provide a superior experience to both discretionary and non-discretionary clients/portfolios.

The Buy-side will have the ability to choose its own sell-side partners, reach any destination worldwide, With ready out of the box connectivity to Bloomberg TSOX, EMSX, DMA, Thomson Reuters ATR, NYFIX, and others, as well as integrated real time global data feeds and corporate actions (splits, dividends, etc.). The ZagTrader Buy-side solution can integrate with any back office/banking system without the need to change the infrastructure, or even better, utilize ZagTrader's powerful back office instead!

Supported Instruments

- Equities Long / Short

- Futures Contracts Long / Short

- Leveraged Forex Long / Short

- CFDs Long / Short

- Derivatives Long / Short

- ETFs Long / Short

- Bonds and Sukuks

- Options (Calls, Puts, Naked Calls/Puts)

- Funds

Ready out of the box Connectivity to

- Bloomberg TSOX

- Bloomberg EMSX

- Bloomberg DMA

- Reuters ATR

- NYFIX

Global Coverage

- Covers more than 200 Markets (Including US, Europe, Middle Eastern markets)

- With more than 200,000 symbols to choose from

Manage portfolio and risk

- Benchmarking, rebalancing and scenario analysis tools

- Decision support and portfolio management

Optimize workflow

- Customizable workspace

- Order and execution management solutions

- Algorithmic trading capabilities

- Execution management solutions with the ability to route to thousands of destinations, including DMA and dark pools

Enhance compliance

- Pre-trade, post-execution and end-of-day compliance

- Advanced compliance rule building, reporting and complete audit history

- Scalability to support high volumes of trades, compliance rules, accounts and account groups

Lower operational risk

- Post-trade matching, settlement and reconciliation

- Portfolio accounting

- Performance measurement

- Data aggregation and reporting

Giving buy side traders the ability to

- Manage their single stock and list trading processes

- Give them access to algorithmic trading and visual trading

- Pre and post trading transaction analysis

- Have direct market access

- Automated order routing

- Access to real time pricing

- Market Depth

Research Portal

- News feed

- Company profile and financials

- Peer Group Analysis

- Value Analysis

- Advanced Technical Analysis

Back office

- Maker checker deposits that require approval

- Advanced rebate management system

- Native payment gateway for accepting and receiving payments

- Accrued interests on a daily basis

- Automatic update of listings for global symbologies

- Dividends and rights issues system

- Global corporate actions

Flexibility and Scalability

- Multi lingual interface (English, Arabic) with dictionary based capabilities

- Open architecture: allow the trader to implement their own unique strategies.

- Provide white label solutions to other financial institutions

- Provide white label solutions to other financial institutionsSeamless integration with any 3rd party solutions if needed.

- The ability to run more than 100,000 symbols simultaneously

- Extensive user privilege capabilities