Global Markets Platform for Banks, Brokers & Fintechs

From order entry to settlement, run trading, risk, custody and reporting on one unified platform.

What is ZagTrader?

What it is

A full front-to-back trading and investment platform that unifies trading, risk, custody and reporting in one system.

Who it's for

Banks, brokers, asset managers, wealth managers, crypto exchanges and market operators.

What it replaces

A patchwork of OMS/EMS, risk, back-office, reporting tools and custom integrations.

Trusted by 100+ institutions managing over $500B in assets.

Trusted by leading institutions

Launch or modernize your brokerage with a full front-to-back platform, from client onboarding and trading to risk and settlement.

View broker solutionConsolidate portfolios, risk, NAV calculation and client reporting in one system.

View asset manager solutionRun an institutional-grade exchange with integrated custody, tokenization and compliance.

View crypto exchange solutionHow ZagTrader Works

Select your modules

Choose Trading & Execution, Risk & Compliance, Digital Assets, Reporting & Analytics or deploy the full stack.

Deploy

Implement as SaaS or on-prem, in a single region or across multiple regions.

Connect

Integrate with your markets, banks, custodians, KYC/AML providers and data vendors.

Go live

Launch branded portals and apps for your clients with full back-office and reporting.

See the Platform in Action

From desktop trading terminals to mobile apps, ZagTrader delivers a seamless experience across all devices

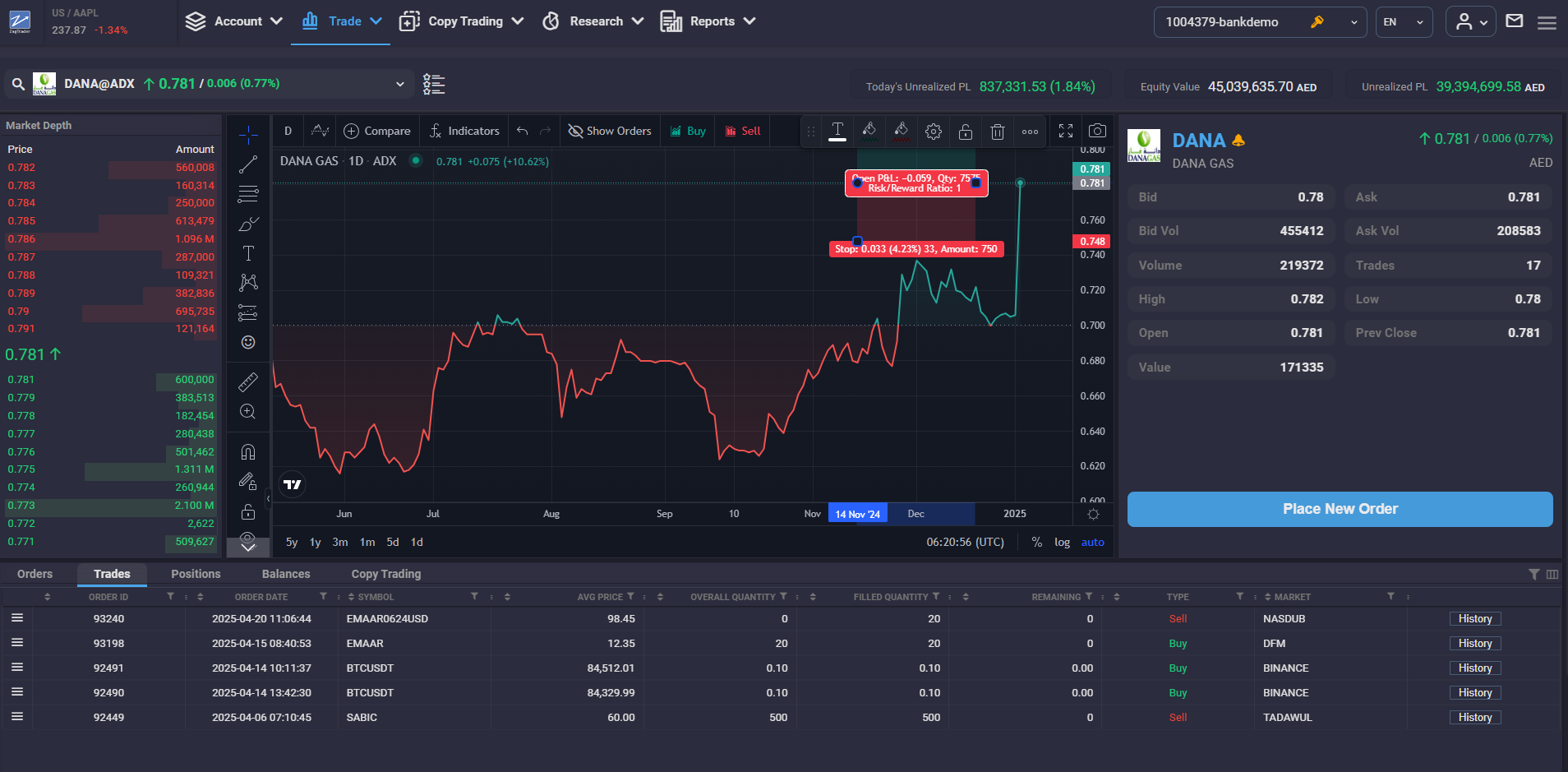

Desktop Trading Platform

Full-featured trading interface with market depth, advanced charts, and order management

Stock Overview

Real-time quotes, charts, and market data

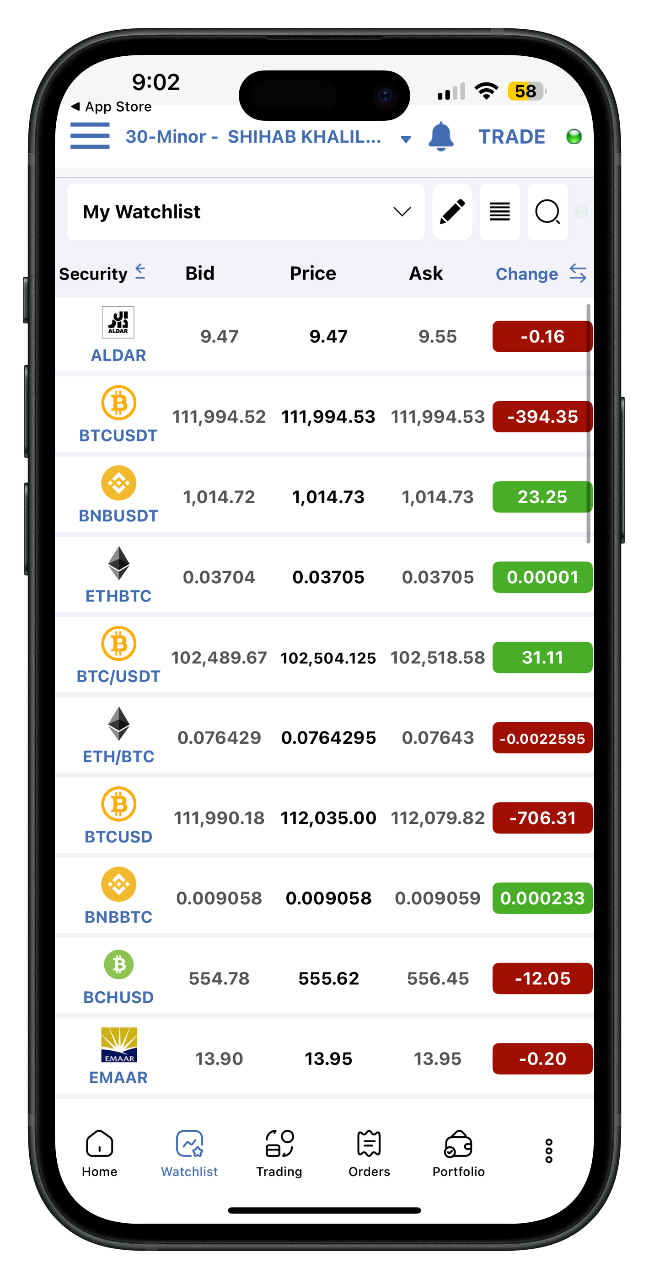

Watchlist

Track stocks and crypto in one unified view

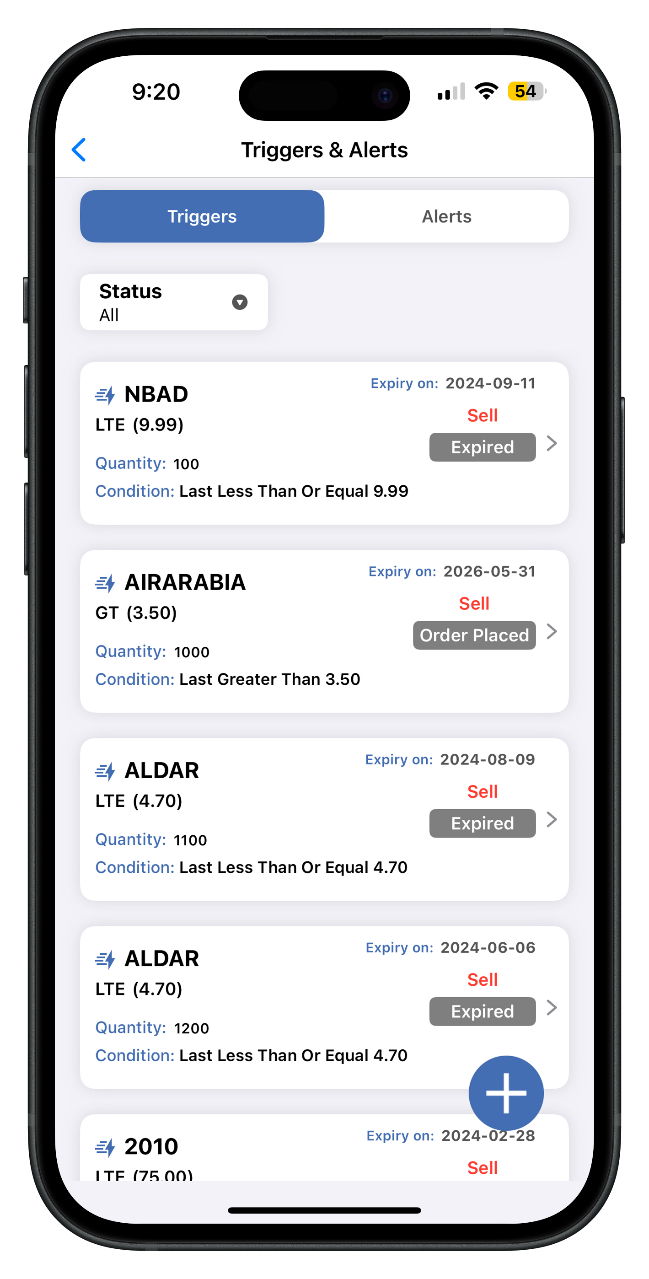

Triggers & Alerts

Automated alerts and conditional orders

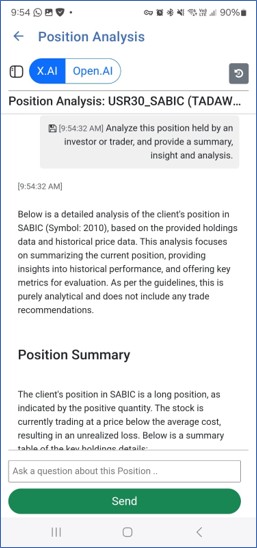

AI Position Analysis

AI-powered insights for your holdings

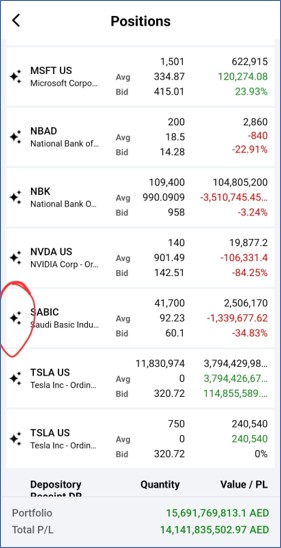

Portfolio Positions

Real-time P/L tracking across all holdings

Security & Compliance by Design

ZagTrader is engineered for regulated financial institutions, with security, auditability and compliance as core design principles.

Role-based access control

Granular permissions across all platform modules

Complete audit trails

Full traceability across trading, risk and back-office workflows

Data encryption

End-to-end encryption in transit and at rest

Global regulatory support

Built-in support for regulatory regimes and reporting requirements

Certifications & Frameworks

ISO 27001

Information security management

SOC 2

Security & availability controls

GDPR

Data protection compliance

MiFID II

EU markets directive support

FATCA

US tax compliance reporting

EMIR

Derivatives reporting framework

Platform Highlights

Everything you need in one unified platform, designed for modern financial institutions

Unified OMS + EMS

For Equities, FX, Crypto, Derivatives

- Multi-asset trading

- Smart order routing

- Algorithmic execution

Real-time Risk & Compliance

Controls built into every workflow

- Pre-trade risk checks

- Real-time position monitoring

- Regulatory compliance

Full Custody & Reporting

Settlement, General Ledger, and Reporting

- Asset safekeeping

- Corporate actions

- Regulatory reporting

Modular Architecture

Multi-Asset, Cloud-Ready, API-First

- Microservices design

- RESTful APIs

- Cloud deployment options

Frequently Asked Questions

Get answers to common questions about ZagTrader