Banking as a Service (BaaS)

Customers have changed the way they live and make a living, the world today is getting slowly empowered by ever-present online accessibility and technological improvements, the banking industry is experiencing a massive transformation. Neobanks are offering more convenience for business, money transfers, trading and investment management. Therefore, it comes as no surprise that the traditional banking industry is under tremendous pressure to move their focus from product -based, limited underlying architectures and sluggish slow pace of change.

The emergence of Banking-as-a-Service (BaaS) Technology with innovative API driven connectivity, cloud technology stacks and efficient framework based on agile methodologies has enabled ZagTrader to move brick and mortar financial institutions and helping them obtain a viable competitive edge and ensure better innovation, profitability, and expansion to new markets and subsequently staying in the game.

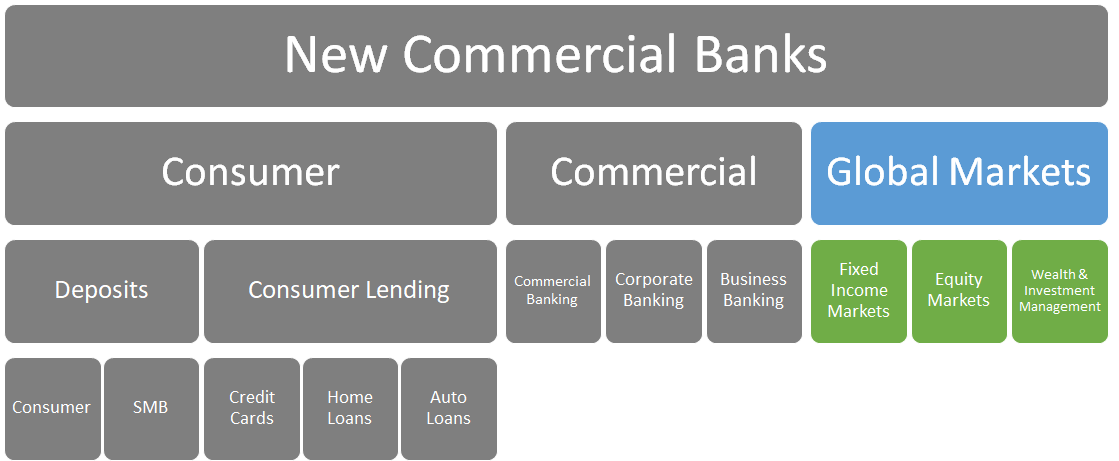

Classic Commercial Banking Landscape

Typical banking services include

- Treasury

- Lending

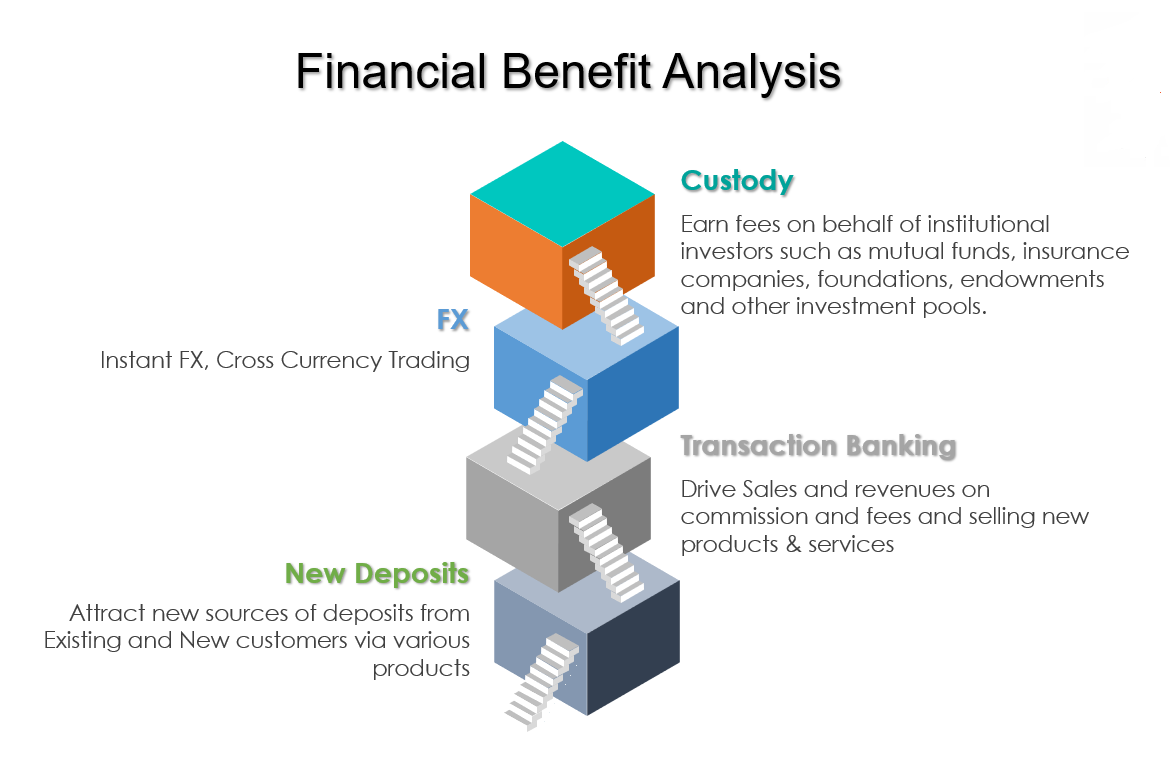

- Transaction Banking

- Custody

- Private Banking

- Wealth Management

Unable to scale – target the same customers and offer difference variations of the same product (credit cards, loyalty programs, etc.)

You’re Not So Conventional White-Label Offerings

ZagTrader BaaS Management platform – is specially engineered for banks and integrates to banks’ core banking platforms seamlessly with a clear and flexible governance framework that will easily adapt to the dynamic business environment.

Banks can opt for a module-based model and work according to corporate standards, use institutional grade tools to ensure consistency, adaptability, speed, and confidence across the entire ecosystem. This way, banks can transform business components into interchangeable and reusable assembly units of processes or services that can be quickly modified without affecting other blocks.

Your Bank’s Building Blocks for Product Offering

- New Products can be integrated in the day-to-day operations in the bank to become effective building blocks in the bank’s offerings.

- Increase the competitiveness of the bank and raises the bar very high for competition to catch up

Maintain Full Independence – select the counter-party banks around the World to deal and settle with.

Potential Growth & Multi-Layered Offering as BaaS

- Commodity-backed Accounts, such as Gold, etc

- Custom ETFs

- Instant Global Trading of:

- Stocks

- Bonds and Sukuks

- Treasury Bills

- Derivatives

- Currencies & FX

- REITS / Real Estate Trusts

- Portfolio Consolidation

- Traditional & Digital Assets

- Wealth Management and Advisory

- Custody Services

Attract local and international new types of clients (Retail and High Net-worth)

Key Benefits Increasing Efficiency & Productivity

- Managing your employees

- Full privilege/permission system with complete automation of workflows and processes

- Reduced Risk and Manual Intervention

- Automation of clients onboarding

- KYC

- Document Management

- Capabilities to route your orders to multiple destinations

- Risk Management

- Algo Trading

- Mobilize your customers with white-labelled mobile and tablet apps to view and trade their portfolio in real time

- Fully white-labeled solution

- Expand business to millions of local customers and billions globally

World at your Finger Tips

Mobile Application

Customers trade whenever and wherever

200+ Global Markets

Realtime Market Data Feeds. Buy / Sell in multiple market

Single Integrated Interface

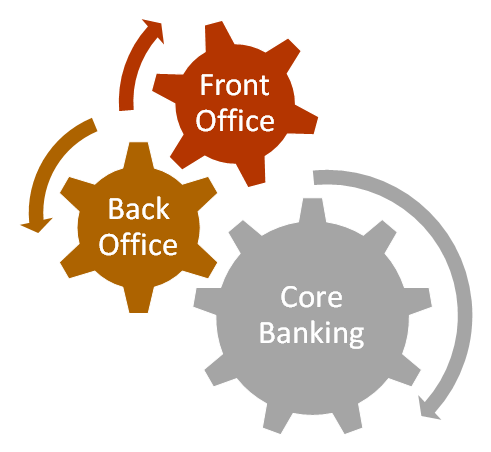

All Departments connected under ONE System

Calculate Fees & Charges

Real time lien and calculation of fees and charges with complete audit and reporting

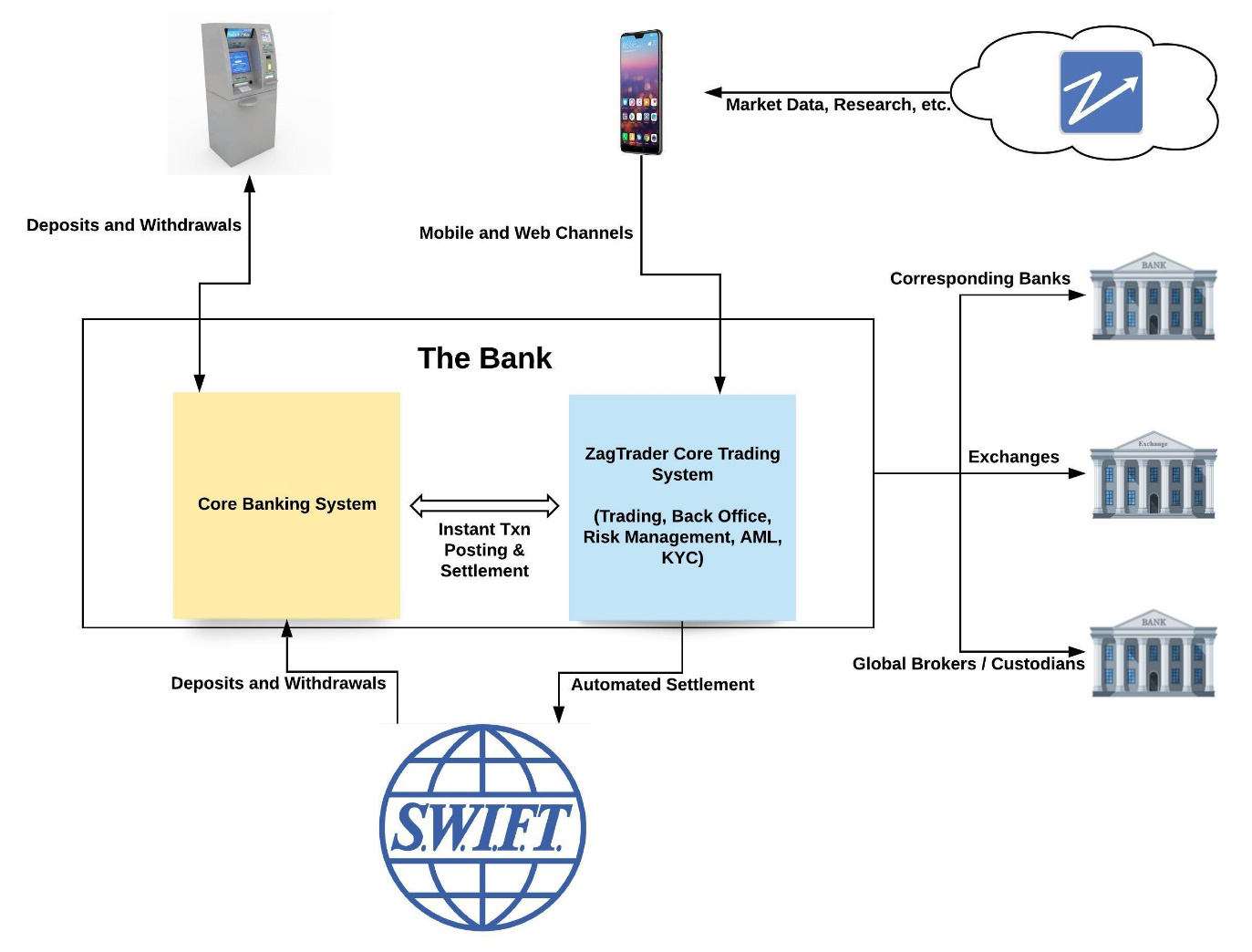

Connect Core Banking System in Realtime

Real time synchronization and access to core banking system

Scalable & Cost Effective

Introduce New Products Generate New streams of Income.

How does it work?

ZagTrader Banking-as-a-Service (BaaS) Management platform is an available, out-of-box and ready to use trusted global platform that delivers the needed functionality end-to-end with seamless integration to core banking – which will work across all of the departments – treasury, transaction banking, 100% risk free lending, and custody. A platform that offers to leverage core banking with complimentary technology that eliminates the need to choose between agility and scalability.

ZagTrader is one of the only platforms that can provide a full comprehensive end to end solution, plug and play with unmatched flexibility, which is needed due to the diverse linked audience.

From our experience working on similar projects: We place keen focus on the business rules and zero focus on technology integration, else the project can go to an unforeseen complexity and potential setbacks and huge increase of cost and time if you need to work on integrations with many platforms, systems, business rules, and may involve too many added risks in getting into a development setup.

Enabling Cross – Operational Coverage & Benefit

Next Generation Commercial Global Banking

Collaborate to Innovate with ZagTrader

For a complete list of ZagTrader's Global Features

Please Click Here